1. The Standard Deduction:

The standard deduction has been nearly doubled for every filing status. The standard deductions are now:

$24,000 for those filing married filing jointly and surviving spouses;

$18,000 for those filing head of household;

$12,000 for those filing single and married filing separately

$1,050 for those filing who are a dependent of another.

2. Itemized Deductions

Itemized Deductions have had several limitations forcing most taxpayers to use the Standard Deduction instead of the itemizing their deductions. Some of the more important limitations are as follows:

The state and local tax (“SALT”) deductions have been limited to $10,000 for those individuals filing jointly. The greater of general sales taxes paid or state and local income taxes, real estate taxes and excise taxes are subject to this new limitation.

Unreimbursed employee expenses are no longer deductible.

The mortgage interest deductions for new loans have been reduced from $1,000,000 to $750,000 and home equity interest deductions have been eliminated unless the debt is used to buy, build or substantially improve the real estate of the taxpayer borrowing the funds. There are some exceptions to these new general rules.

Charitable contributions remain deductible if a taxpayer itemizes their deductions.

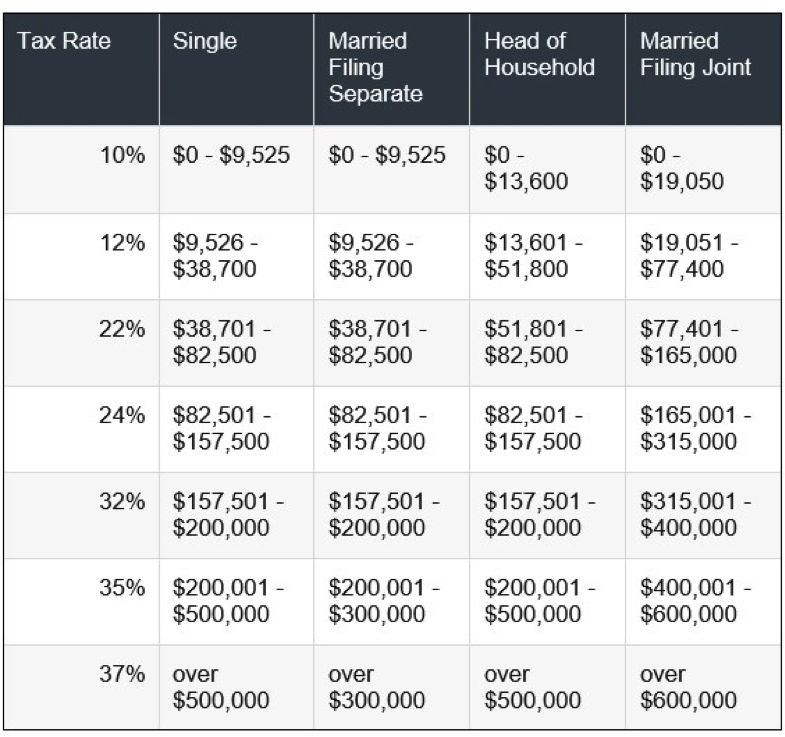

3. 2018 Income Tax Rates

2018 Income Tax Rates have been reduced by approximately 2% in each of the seven tax brackets.

As you can see from the new tax brackets, the “Marriage Penalty” is alive and well in the tax code.

4. Personal and Dependency Exemptions.

The new tax law suspended deductions for personal exemptions from 2018 through 2025.

5. Child Tax Credits

Qualifying children under 17 years of age had previously received a $1,000 credit which has now been increased to $2,000. The income level for the phase out of the child tax credit for those filing jointly has increased from $110,000 to $400,000 and from $110,000 to $200,000 for all other tax filers. Note there are limitations on how much of the child tax credit is refundable and a social security number is now required to claim the credit.

6. Retirement Plan Limits

| 2018 | 2019 | |

| 401(k) and 403(b) contribution levels | $18,500 | $19,000 |

| Catch up limits for those over 50 years of age | $6,000 | $6,000 |

| Simple IRA contribution levels | $12,500 | $13,000 |

| Catch up limits for those over 50 years of age | $3,000 | $3,000 |

| Traditional and Roth IRA Contribution Limits | $5,500 | $6,000 |

| Catch up limits for those over 50 years of age | $1,000 | $1,000 |

Income Phase-Outs apply.

Recharacterization of IRAs to Roth IRAs can no longer be reversed as in previous tax years.

7. Health Savings Accounts (HSAs)

| 2018 | 2019 | |

| Families | $6,900 | $7,000 |

| Individuals | $3,450 | $3,500 |

| Catch Up limits for those over 55 years of age | $1,000 | $1,000 |

8. Student Loan Interest Deduction

Student loan interest is deductible up to $2,500. This deduction is phased out for joint filers with adjusted gross income of $135,000-$165,000 and for all other filers with adjusted gross income from $65,000 to $80,000. Discharge of student loans is not income if caused by a death or disability.

9. Mileage Allowances

| 2018 | 2019 | |

| Standard Mileage Allowance per mile | 54.5 cents | 58 cents |

| Charitable Mileage Allowance per mile | 14 cents | 14 cents |

| Medical and Moving Allowance per mile | 18 cents | 20 cents |

10. Employment Taxes Wage Base

| 2018 | 2019 | |

| Social Security Taxable Wage Base | $128,400 | $132,900 |

| Medicare Taxable Wage Base | Unlimited | Unlimited |

High Income Earners are subject to an additional .09% Medicare tax over certain income thresholds.

For questions or more information please reach out to us at 317-636-5561 or at ppittman@ppittman.com.